As we close out Hispanic Heritage Month, I want to emphasize the critical importance of improving housing outcomes for the Latino community. The Biden-Harris Administration is committed to racial equity, with an emphasis on financial inclusion for historically underserved groups. This commitment to equity informs our work at Ginnie Mae and affirms what Congress established us to do; to serve all American households, with a special emphasis on communities that have not always shared in the economic growth and security many of our fellow Americans take for granted.

With respect to the Latino community, however, making sure the housing finance industry adequately serves us is not just a matter of fairness, it is integral to the continued stability and growth of a significant part of our economy. Put another way, improving housing outcomes for Latinos benefits all Americans because our economy depends on a vibrant housing sector.

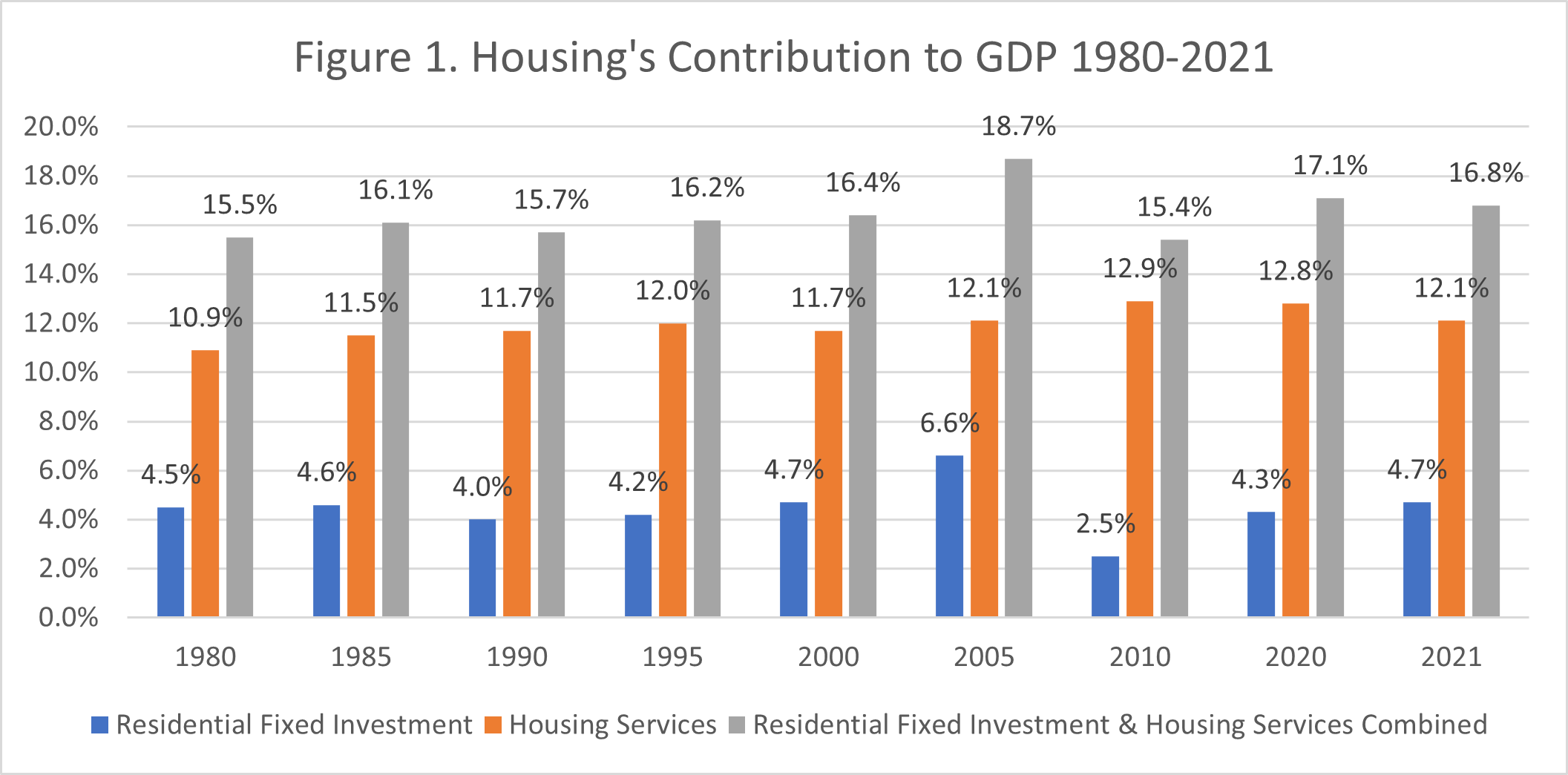

Housing, writ large, is a significant portion of the U.S. economy and is often a leading indicator of our economic strength or volatility across cycles. The housing sector’s combined contribution to GDP was 16.8% in 2021 (Figure 1). Roughly 12% of this portion of GDP was the result of spending on housing services, which includes gross rents, as well as mortgage and utility payments.1 The construction of new single-family, manufactured housing, and multifamily structures, residential remodeling, and brokers’ fees accounted for 4.7% of GDP.

Source: National Association of Home Builders.

The demographics of the median prospective homeowner are about to undergo a major shift. As older generations of homeowners seek to move out of traditional single-family housing, younger households must be able to secure financing to replace the current source of housing demand. These younger households are disproportionately Latino.

Baby Boomers held 44% of all real-estate wealth in 2021, compared to 31% for Generation X, which is the next-wealthiest generational cohort.2 Moreover, much of this older generation’s wealth is contained in their homes, a 2006 GAO report stated that housing represented a greater share of total wealth than financial assets for most Baby Boomers.3 In 2019, Baby Boomers numbered 71.6 million and 75.1% of them still owned their homes indicating that they have not yet begun to transition from homeownership to alternative living arrangements in substantial numbers and it is expected that available housing stock will remain in high demand in the near term.4

However, by 2030 the entire Baby Boom generation will be older than 65. Fannie Mae projects that the number of older individuals exiting homeownership between 2026 and 2036 will be between 13.1 million and 14.6 million, which is an increase of 42% over the number of older homeowners who exited between 2008 and 2018.5 This demographic shift is likely to result in significant increases in housing supply in the medium and long-term.

At the same time, the Latino community continues to grow and represents a significantly younger portion of the U.S. population. In 2019 it was and continues to be the second largest ethnic group in the U.S. population (18.5% in 2019, increasing to 18.9% in 2021, according to Census Bureau data). Latinos accounted for about half of the growth of the U.S. population between 2010 and 2019.6 According to the Federal Reserve Board’s Survey of Consumer Finances (SCF) in 2019, 72% of all Hispanic households were headed by individuals from the three youngest generations in the labor force (Gen Z, Millennial Gen and Gen X, ages 18-54). In comparison, in that same year, the majority (50.4%) of White non-Hispanic households were headed by a member of the oldest generations in the U.S. population (Baby Boom and Silent Generation, aged 55 and over).

Latinos, however, make up only 10.4% of the homeowners from Generation X and 12% of the homeowners from the Millennium generation. Despite most White households being members of the oldest generations (Baby Boom and the Silent Generation), they make up 73.9% of the homeowners from Generation X and 72.4% of the homeowners from the Millennium generation.7

And while it is clear that Latinos are a core component of U.S. population growth and labor productivity and will be for generations, current Latino homeownership rate increases have been slight and are not projected to meet the coming demographic-driven housing supply surplus. In 2019, the home ownership rate of Hispanic households was 47.6%, which is significantly below the national average rate of 64.9% By the second quarter of 2022, the home ownership rate of Hispanic households increased slightly to 48.3%, but so did the national rate of home ownership, which went up to 65.8.8

The looming surplus of single-family housing stock across generations and the current homeownership gap that Latinos face present an urgent challenge and compelling opportunity. Policymakers, financial institutions, and experts need to work in lockstep to help more Latino households access affordable credit, not just because this is the equitable thing to do, but because the stability of this vital part of the economy demands that we give these households the tools to become homeowners.

This is a challenge that Ginnie Mae strives to meet each day. Last year, Ginnie Mae, through FHA, supported more than 220,000 Latino households in homeownership. To date this year, 13% of Ginnie Mae’s FHA borrowers were Latino, and approximately 60,000 of these households were first time homeowners. But we know that we can, and must, do more. Our commitment to improving housing outcomes for Latino households and all historically underserved groups informs much of the work we have taken on under President McCargo’s leadership. We are seeking to bring more CDFIs and other mission-driven lenders into our ecosystem because we know that these institutions have a track-record of serving historically underserved communities. We are bringing greater insight into the communities we serve to our investors through enhanced collateral disclosures because we believe the developing Environment, Social, and Governance (ESG) investment community can provide new support to those we serve. We are working with our colleagues at the Federal Housing Administration because we know that manufactured housing can be a source of quick-to-build naturally occurring affordable housing. Across Ginnie Mae, and HUD, we are working to give historically underserved groups the tools to access homeownership, not just because it is the right thing to do, but because it benefits us all.

__________________________________________

1-Source: National Association of Home Builders (https://www.nahb.org/news-and-economics/housing-economics/housings-economic-impact/housings-contribution-to-gross-domestic-product#:~:text=Housing's%20combined%20contribution%20to%20GDP,homes%2C%20and%20brokers'%20fees)

2-Analysis performed by NY Times using data from the Federal Reserve Board (https://www.nytimes.com/2021/07/08/realestate/baby-boomers-rich-with-real-estate-and-not-letting-go.html)

3-Source: Government Accountability Office (https://www.gao.gov/assets/a250908.html).

4-Source: 2020 Pew Research Report “Millennials overtake Baby Boomers as America's largest generation" and the 2019 Survey of Consumer Finances (SCF).

5-2018 Fannie Mae report, “The Coming Exodus of Older Homeowners," (https://www.fanniemae.com/media/20281/display).

6-Source: 2020 Pew Research Center report, “U.S. Hispanic population surpassed 60 million in 2019, but growth has slowed."

7-Source: The Federal Reserve Board's Survey of Consumer Finances (SCF) from 2019.

8-Source: All 2019 figures came from the Federal Reserve Board’s Survey of Consumer Finances (SCF). The 2022 figures came from the Federal Reserve Bank of St. Louis and reflect Quarter 2 levels.