Page Content

Ginnie Mae continues to modernize its Securitization Platform technology, processes, and related policies in response to the growing need for improved service delivery to its Issuers and investors, creating a fairer, more affordable and equitable housing finance system. Toward this goal, Ginnie Mae is transforming its platform operations to deliver greater business value.

Our migration to a public cloud is the foundation for our modernization and transformation initiatives. Ginnie Mae's efforts were recently acknowledged by peers in the technology industry when the agency was named a 2022 CIO 100 award recipient, recognition assigned to organizations that exemplify the highest level of operational and strategic excellence in information technology. This transition to a mature public cloud enhances Ginnie Mae's ability to respond to market changes and develop new products that help America's homeowners and renters.

Ginnie Mae has continued to invest in technology modernization and optimization efforts designed to simplify doing business with us. We expanded the functionality and value proposition of MyGinnieMae, our business processing hub, by launching important pooling tools for single- and multi-family as well as Platinum securities, helping to streamline those products. Additionally, we incorporated a state-of-the-art centralized helpdesk into the portal that significantly enhances the customer experience.

The broad details of these efforts were outlined in the 2022

Annual Report, an article by Barbara Cooper-Jones, SVP of Enterprise Data and Technology in the Ginnie Mae Housing Analysis & Policy Spotlight (HAPS)

blog.

Technology modernization powers Ginnie Mae's enhanced securities disclosure. Enhanced disclosure of the mortgages underlying Ginnie Mae MBS give a clearer picture of Ginnie Mae's market-leading support for affordable housing and first-time homeownership, key visibility tools for investors interested in making Social investments as part of their broader Environmental, Social and Governance portfolio targets.

In addition to increasingly deeper data into the Social aspect of Ginnie Mae's MBS, technology driven data tools help Ginnie Mae report out the way its securities further Environmental investment goals portfolio managers may have. Overall, Ginnie Mae's ESG disclosure are aligned with the Biden-Harris Administration's commitments to affordable housing and environmental sustainability.

For an additional list of documents, publications, processes and further information regarding our modernization effort, please refer to technology and modernization articles published in the

HAPS blog and in the tables below.

(Hidden) Start Accordion [1]

Start Accordion

Add any web parts that will be in your accordion below this block and then add an End Accordion web part after your last content web part. Add any web parts that will be in your accordion below this block and then add an End Accordion web part after your last content web part. Each web part must have its Chrome State, under the Appearance web part properites, set to Title Only. When you save the page and exit edit mode, the accordion will render.

Document Custodian Transfer Request (DCTR) Application

Ginnie Mae is enhancing the MyGinnieMae portal by introducing a dedicated application for Document Custodian transfer and merger requests, providing Issuers and Document Custodians with improved and more efficient processing experience.

Starting April 14, 2025, the new DCTR application will be accessible via the Applications -> Other Applications menu in MyGinnieMae. Access to the functionality will be seamless for users who currently perform Document Custodian transfers and mergers in GinnieNET and have the necessary functional roles. When DCTR is launched, Document Custodian transfer and merger request transactions will no longer be performed in GinnieNET.

The new DCTR application introduces enhanced features and functionality that will provide benefits to both Issuers and Document Custodians. DCTR users will be able to leverage improved processing flow, enhanced pre-submission checks to mitigate potential downstream errors, explicit acknowledgement prior to submission, and improved notifications and reporting. Ginnie Mae will now approve/decline both merger and transfer requests in DCTR and have enhanced insight into the process via notifications and reporting.

For more information, please refer to the sections below and check back for ongoing updates.

Ginnie Mae Central (GMC) Financials Module

Ginnie Mae is excited to introduce Ginnie Mae Central (GMC), a comprehensive application within MyGinnieMae designed to revitalize and enhance three core business processes: Insurance, Financials, and Compliance & Monitoring (C&M). GMC will improve the efficiency, accuracy, and accessibility for Issuers, Subservicers, and Document Custodians in managing these business processes.

The Financials module streamlines the Audited Financial Statement (AFS) package submission process for Issuers (currently managed under the Independent Public Accounting module). Through this updated process, stakeholders can expect more streamlined communication and less churn in submitting and reviewing documentation. Stakeholders of the Insurance and Financials processes can leverage the materials below to learn about the process and tools that are changing for this modernization effort.

(Hidden) Single Family Pool Delivery Module (SFPDM) - MISMO

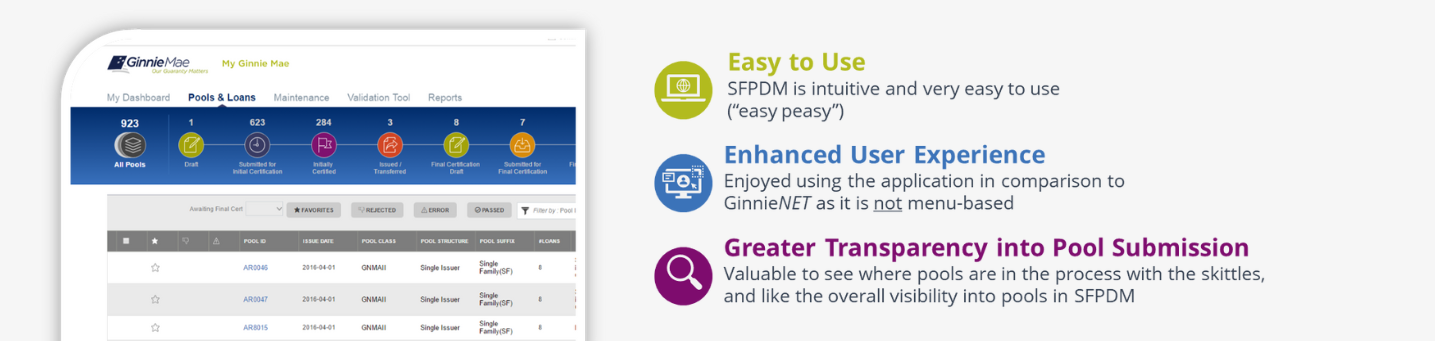

The Single Family Pool Delivery Module (SFPDM) is Ginnie Mae’s modernized application for the delivery of Single Family and Manufactured Housing issuance data. This application offers several new capabilities, including greater transparency into the progress of submitted pools through an intuitive and user-friendly interface.

The Single Family Pool Delivery Module (SFPDM) is Ginnie Mae’s modernized application for the delivery of Single Family and Manufactured Housing issuance data. This application offers several new capabilities, including greater transparency into the progress of submitted pools through an intuitive and user-friendly interface.

The modernized application supports the submission of Ginnie Mae’s new Pool Delivery Dataset (PDD), which leverages the mortgage data standards and XML specifications created by the Mortgage Industry Standards Maintenance Organization (MISMO). Ginnie Mae’s PDD is specific to Ginnie Mae’s business model and therefore contains some unique data points that may not be a part of other MISMO compliant datasets within the mortgage industry. Additionally, SFPDM allows Issuers to manually enter pool and loan data if they do not intend to import data using PDD files.

On June 1, 2023, Ginnie Mae released

APM 23-08 announcing the required PDD/SFPDM implementation date and the revised GinnieNET cutover. The latest SFPDM Adoption Timeline can be found

here.

The three key components of this adoption effort are:

-

Pool Delivery Dataset (PDD) - MISMO v3.3-compliant XML-formatted data for Single Family pools and loan import to SFPDM

-

Validation and Testing Tool (VTT) - Testing application for validating PDD structural and data specifications, as well as Ginnie Mae Business Rules or Edits

-

Single Family Pool Delivery Module (SFPDM) - New production application for PDD submissions to replace GinnieNET

Issuers are expected to use the information and tools provided on this page to prepare for the transition to SFPDM. For additional information and questions, please email

askGinnieMae@hud.govor call Ginnie Mae Customer Support at

1-833-466-2435.

(Hidden) End Accordion [1]

End Accordion

Add any web parts that will be in your accordion above this block and below the Start Accordion block. Add any web parts that will be in your accordion above this block and below the Start Accordion block. When you save the page and exit edit mode, the accordion will render.

(Hidden) Start Accordion [2]

Start Accordion

Add any web parts that will be in your accordion below this block and then add an End Accordion web part after your last content web part. Add any web parts that will be in your accordion below this block and then add an End Accordion web part after your last content web part. Each web part must have its Chrome State, under the Appearance web part properites, set to Title Only. When you save the page and exit edit mode, the accordion will render.

(Hidden) End Accordion [2]

End Accordion

Add any web parts that will be in your accordion above this block and below the Start Accordion block. Add any web parts that will be in your accordion above this block and below the Start Accordion block. When you save the page and exit edit mode, the accordion will render.

Last Modified: 2/19/2026 12:48 PM