Key Takeaways

- Mexican investors demonstrated broad interest in Ginnie Mae MBS, citing the attractive yields relative to other government-guaranteed fixed-income investments, the desire to diversify portfolios, and the need for liquidity.

- Lingering anxieties about the 2008 financial crisis remain top-of-mind for potential Agency MBS investors.

- An opportunity exists to educate and bring awareness of Agency MBS in the region.

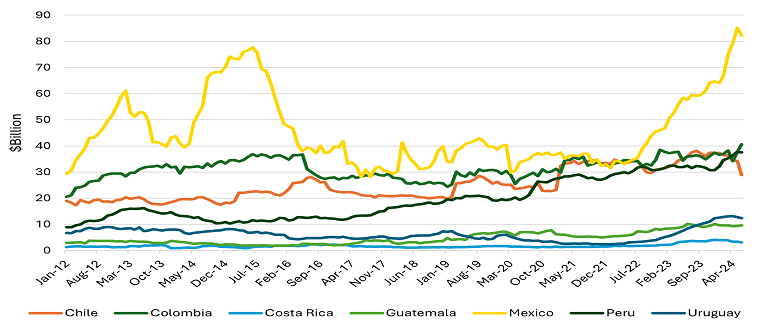

Last month, Ginnie Mae staff led by Senior Vice President of Capital Markets John Getchis hosted a series of strategic engagements in Mexico City focused on strengthening international partnerships and expanding the global footprint of Ginnie Mae’s investor base. Consisting of pension funds, domestic and international banks, and the Central Bank of Mexico, this exploratory trip marked Ginnie Mae’s first outreach to the Latin American investor market. U.S. dollar-denominated debt in Mexico has increased substantially since the Federal Reserve began raising rates in early 2022. Chart 1 shows an increase of more than $42 billion since the first quarter of 2022.

Chart 1. U.S. Treasury Holdings in Select Countries of Latin America

Source: Treasury International Capital System (TIC) & Recursion

For investors looking for yield and to diversify away from the Mexican Peso, the current investment environment suggests an interesting case for investments in mortgage-backed securities (MBS). One of the most attractive aspects of Ginnie Mae MBS is the ability to structure cash flows through coupon selection, enabling investors to customize the duration, convexity, and yield profiles to meet their portfolio goals while not giving up yield relative to the 10-year U.S. Treasury Note (US10Y). Chart 2 below shows the performance of G2 Single-Family (SF) index spread to the US10TY since 2021. As you can see, although there has been some variability in spreads, G2s have consistently outperformed US10Ys. This, of course, is very attractive to investors looking for exposure to U.S. fixed-income debt instruments with a deeply liquid market backed by the U.S. Government guarantee.

Chart 2. GN II SF Spread Over10-Year U.S. Treasury Note

Source: Bloomberg

The difference in yield can be attributed to how the market prices the inherent risk in the structure of Agency MBS. Many fixed-income investors regard the incremental yield of Ginnie Mae MBS over the US10Y as being comprised of several risk components. The principal factor among these, and maybe the least understood, is prepayment risk—the risk that a borrower can pay down or refinance their mortgage at any time without penalty, which would reduce the yield to investors. Mortgage-backed securities provide more income relative to Treasury debt to compensate for these risks.

In addition to yield profiles, many investors were intrigued by the size of the U.S. MBS market, the trading volumes and depth of the liquidity, the zero-percent risk weight for regulated banks, the floating rate classes of REMICs, and the current array of coupons. For some, investment in MBS can help diversify portfolios against exposure to equities and corporate bonds. Due to how they are structured and paid, mortgage-backed securities respond to macroeconomic trends differently than corporate bonds or equities, so for an investor looking to diversify a portfolio, Agency MBS can be an attractive proposition.

Initial meetings with Mexican investors revealed a strong interest in learning more about Agency MBS. However, many investors were also interested in understanding the impact of Ginnie Mae MBS during the 2008 financial crisis, demonstrating a lingering anxiety around the financial crisis that may be causing some to be generally more hesitant toward holding MBS. There is an opportunity to bring awareness to the Agency MBS product in the region, conveying Ginnie Mae’s performance during the crisis and the considerable changes to the housing finance regulatory environment in the last 15 years.